Navigating the waters of healthcare can feel like walking a tightrope, particularly for those holding insurance plans that are often perplexing. For families grappling with the impact of addiction, understanding the nuances of their coverage can be even more critical. That’s why we’re diving deep into seven effective secrets that will help the healthcare insured maximize their policy benefits, easing some of the stress that comes with seeking treatment for themselves or their loved ones.

Top 7 Secrets for Healthcare Insured to Maximize Coverage

A deep dive into your healthcare policy can be a lifesaver. Many families, especially those insured under SSA Medicare, miss out on preventive services, primarily because they aren’t aware they’re eligible. Becoming familiar with the ins and outs of your coverage can lead to better access to necessary treatments, which is especially important for families navigating addiction issues.

If you’re looking to stretch your healthcare dollars, an HSA could be a game changer. These accounts allow you to set aside money tax-free for medical expenses. When paired with high-deductible plans, it helps to manage those out-of-pocket costs. In difficult times, like supporting a loved one through recovery, every little bit helps.

Many insurance plans cover preventive services at no cost. For instance, Young America Insurance provides free annual check-ups and vaccinations. Taking these free preventative measures can help catch potential health issues early, saving both time and money in the long run, particularly for families who are already strained due to addiction.

It’s essential to always check which healthcare providers are in-network with your insurance to avoid surprise bills. For example, CPH Insurance often has limited networks for specialists. Make it a habit to verify and stick to in-network services, ensuring you don’t end up with unforeseen high expenses that can add to your current worries.

Did you know that many claims are denied due to simple administrative errors? Familiarizing yourself with the appeals process can make a significant difference. Just ask the Florida woman whose perseverance in appealing a denied claim led to her Cedar Health Plan covering an essential surgery. Don’t be afraid to advocate for your needs or those of your loved ones.

Take the time to look into extra programs offered by your insurer. For instance, Cedar College has teamed up with carriers to provide discounted health insurance options for students. These programs can give relief to young adults stepping into independence, especially in precarious situations when addiction is a factor.

Annual open enrollment periods usually bring changes. Keeping updated through resources like Cedar Health Plan newsletters and other official communications can help you stay on top of changes. Remember, your coverage needs can change as circumstances do, so don’t hesitate to reassess your plan regularly.

Innovative Solutions for the Healthcare Insured: Real-World Examples

Real-life success stories breathe hope into the often challenging dialogue of healthcare.

Consider the case of a retiree in Ohio who took the time to dive into his SSA Medicare benefits. He discovered additional services that addressed chronic conditions, ultimately improving his quality of life. This underlines the importance of positive engagement with your insurance policy, especially when navigating life changes due to addiction or recovery.

Advancements in mobile technology are revolutionizing how we approach health and insurance. Apps like GoodRx are making it easier for users to find discounted pharmacy prices, emphasizing the intersection between technology and cost efficiency in healthcare. For families facing financial strain, this can be an incredible asset.

Companies like Hims & Hers have opened up valuable conversations regarding healthcare, particularly regarding telehealth options. While these might not be included in traditional plans, they represent a useful avenue for individuals seeking accessible care, especially in times when mental health support is desperately needed.

Moving Beyond Coverage: The Future of Healthcare Insured

As healthcare continues to evolve, so does the need for comprehensive understanding and action among the healthcare insured.

Insurance providers are increasingly aware of the necessity for mental health resources. Insurers like Young America Insurance are leading the way in making mental health care a significant part of their offerings. Ensuring mental health resources are included in your plan can make a world of difference, particularly for families impacted by addiction.

With research around CBD growing, it’s steadily gaining recognition in treatment plans for issues like pain and anxiety. Innovative insurers are beginning to include these offerings, catering especially to demographics like Cedar College students who may be open to alternative treatment methods.

The Path Forward for the Healthcare Insured

The future of healthcare for insured individuals shines bright. By staying informed about options and savoring the policy complexities, individuals can enhance their healthcare experience significantly.

Decisions made today about health coverage will shape the landscape of insurance tomorrow. As the healthcare industry adapts to new societal demands, individuals must also adjust their understanding of available solutions. Advocacy for health needs and comprehensive care is crucial now more than ever. By standing together, we can voice the needs of those struggling with addiction and work toward building a more equitable healthcare system, one that reflects compassion and understanding.

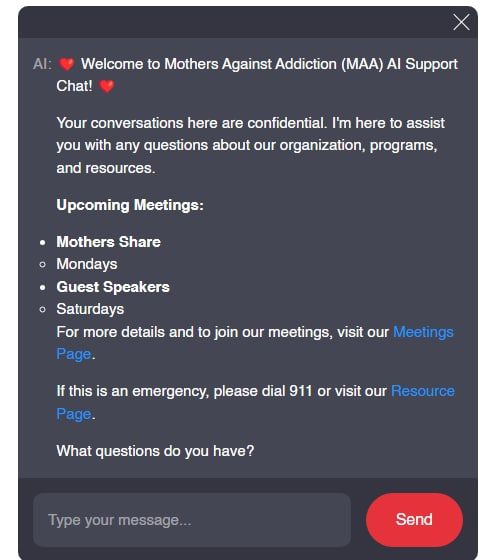

At Mothers Against Addiction, we are committed to supporting families journeying through these challenges. We believe that by having adequate coverage and understanding your rights, you can better help your loved one find the path to recovery. Join us in our mission and let’s turn these challenges into a future filled with hope and healing. After all, whatever it Takes!

Healthcare Insured: Fun Facts & Trivia You Might Not Know

The Wide World of Coverage

Did you know that being healthcare insured can sometimes feel like flipping a coin when it comes to what’s covered? Not all insurance plans are created equal, and understanding the fine print is crucial. For instance, some policies may not cover addiction treatment, which can be especially important for parents grappling with these issues. This is where organizations like Mothers Against come in, offering vital resources for navigating these choppy waters. Speaking of oddities, ever wondered how the term “weird” came to be? It’s an amusing exploration that reminds us that sometimes, insurance policies can feel downright bizarre! If you’re curious, you can define weird for yourself.

The Payout Puzzle

Navigating healthcare can sometimes lead to unexpected perks, like potential payouts from settlements. Consider the Facebook settlement Payout date; if you’re lucky, some insurers might offer cashback or benefits related to wellness programs. The catch is, you often need to keep up with the paperwork, and this is where many folks find themselves in a pickle. After all, being healthcare insured shouldn’t feel as complicated as an action movie starring Erik King! Speaking of movies, did you know that politicians like JD Vance prioritize policies affecting kids when they speak about healthcare? His focus on family well-being is a reminder of how coverage affects the youngest among us.

The Support System

Let’s not forget about the Practitioners making a difference in this landscape. Parents often rely on professionals fully invested in helping kids struggling with addiction. Having access to insightful practitioners can turn the tide for many families. They’re often backed by task forces dedicated to raising awareness, further enhancing available coverage options. So, if you’re all about keeping up with the latest Definitions and policies, that’s a win-win! Ultimately, understanding these aspects of being healthcare insured isn’t just useful; it could be life-changing for those in the thick of it.

One Response

Love this informative support!